Our investment strategy revolves around three core pillars:

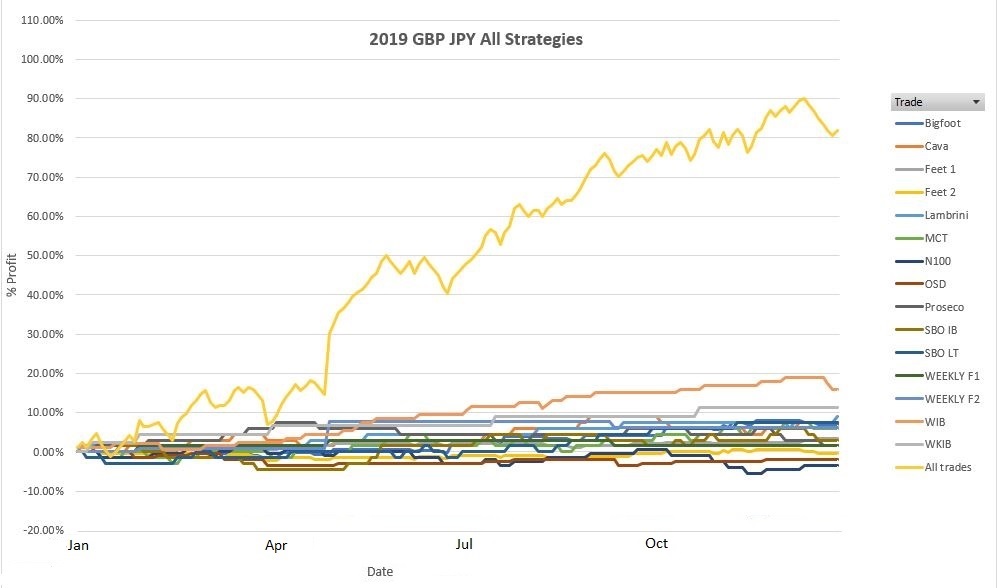

Analysing market data in real-time to identify profitable trading opportunities our experienced team of traders carefully manage risk to ensure these returns. Our trading strategies have been back tested and proven to be highly effective in generating reliable returns in various market conditions. We use both orders to open and live trades to achieve consistently profitable trading years